What is residency tax?

Residence tax (also known as resident tax) is a local tax in Japan. The purpose of this residence tax collection is to ensure funding for local services. The resident tax money will be used for education, welfare, waste treatment, disaster prevention and cultural and artistic activities in the locality.

Residence tax is deducted when calculating PIT

Unlike the personal income tax (所得税) which is calculated based on the total annual income (current year) of the employee, the residence tax (住民税) is calculated based on the total income in the previous year of the employee. motion. However, on a tax basis, the residence tax is still considered a tax on personal income. Accordingly, to be consistent with the principle of non-duplicate tax, the Agreement on Avoiding Double Taxation between Vietnam and Japan stipulates that the local resident tax can be waived if the agreement’s conditions are satisfied. Or this local resident tax will be deducted from the PIT payable in Vietnam if the individual is an individual residing in Vietnam.

Specifically, according to the current guidelines, in the case of a resident individual whose income is generated in Japan and has paid local residence tax in Japan, then:

1, PIT amount (including resident tax) paid in Japan may be deducted from PIT payable in Vietnam.

2, The deducted tax amount does not exceed the payable tax amount calculated according to Vietnam’s tax table and distributed to the income generated abroad. The allocation ratio is determined by the ratio between the amount of income generated in Japan and the total taxable income.

3, Individuals need to provide photocopies of documents proving the amount of tax paid abroad.

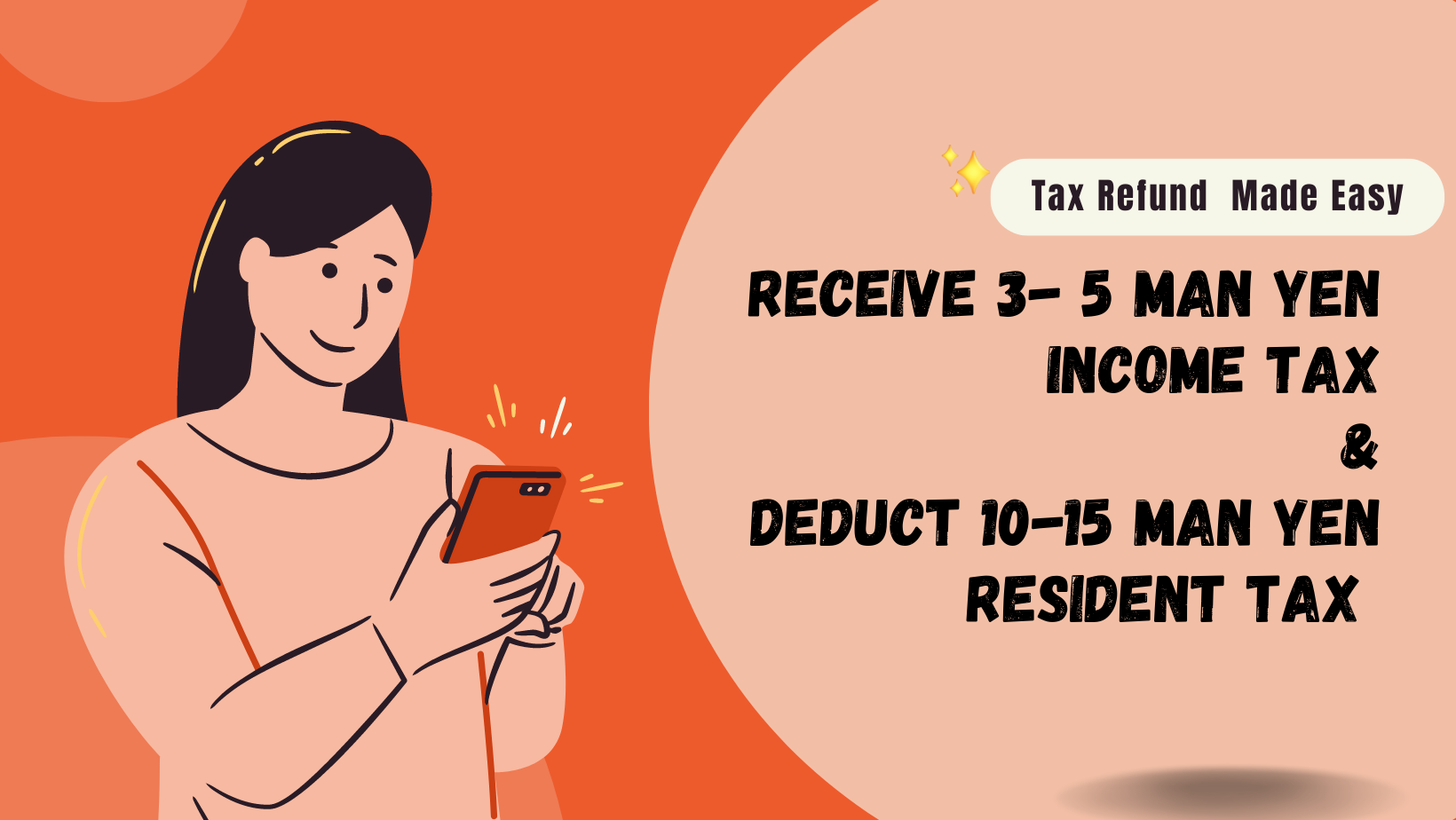

Contact Sugoi Japan today to get consulted with our residence tax refund service with free estimation!